Six choices that turn reporting into strategy

1) Make your boundaries unambiguous

Say what’s inside the report, entities, geographies, operations, and what isn’t. Explain your materiality process (who you asked, how you weighed). Name the audiences you’re writing for and give each a clear entry path. Clarity prevents second-guessing and drives trust.

2) Align to standards, without losing the story

Standards give credibility; your narrative gives meaning. Use IFRS S1/S2 where investor-grade climate/sustainability disclosure is expected; map to GRI for broader stakeholder depth; add sector specifics where helpful. Publish a crosswalk appendix so reviewers don’t hunt, and lead each disclosure with a plain-language summary.

Red Flag: If standards are scattered through the prose, assurance slows and meaning blurs. Map once, reference everywhere.

3)Build an operator-grade metric library

Data people can trust, and audit . For every metric, capture: definition, unit, formula, boundary, data source, frequency, owner, controls. Add year-on-year and vs-plan comparability, peer context, an evidence drawer (working files, method notes), and a change log so trends stay honest.

Spark Insight: A number without a method is a claim. A method without an owner is a risk.

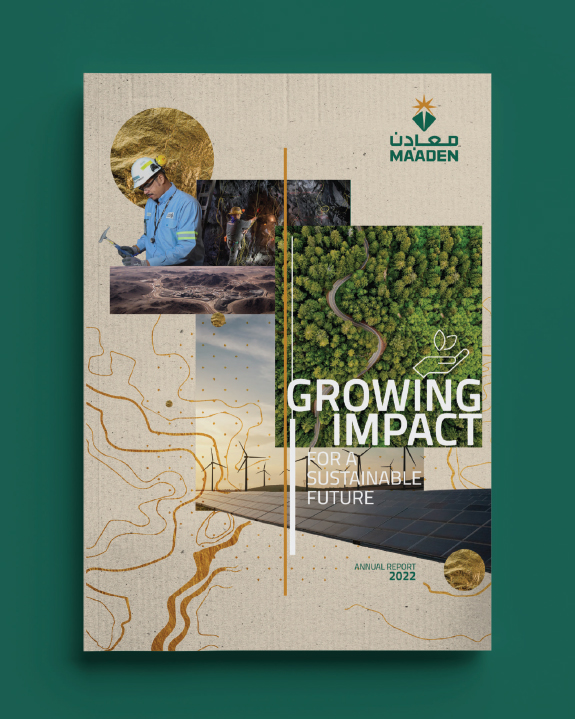

4) Tie targets to strategy, capital, and risk

Make the business case explicit. Show target ladders (1–3–5 years) with capex/opex notes; link to tender eligibility, financing terms , insurance conditions, and intensity improvements (energy, water, waste). Put governance hooks in plain sight: board oversight, management KPIs, escalation paths. The report should read like strategy, not charity.

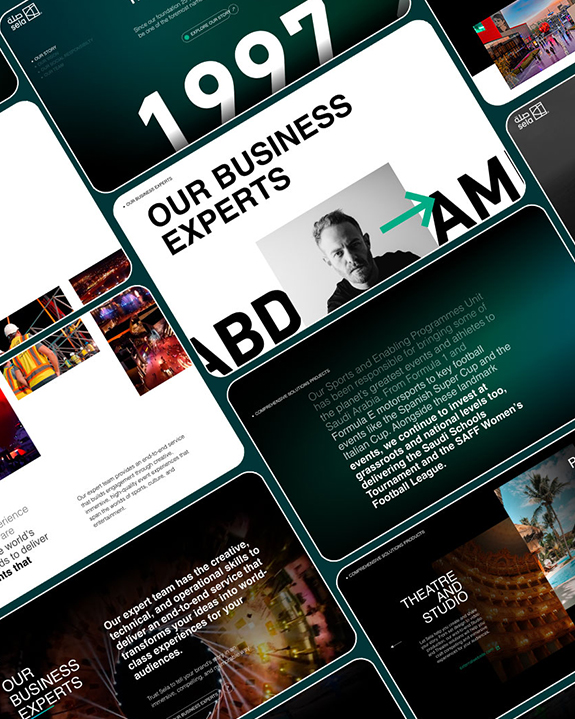

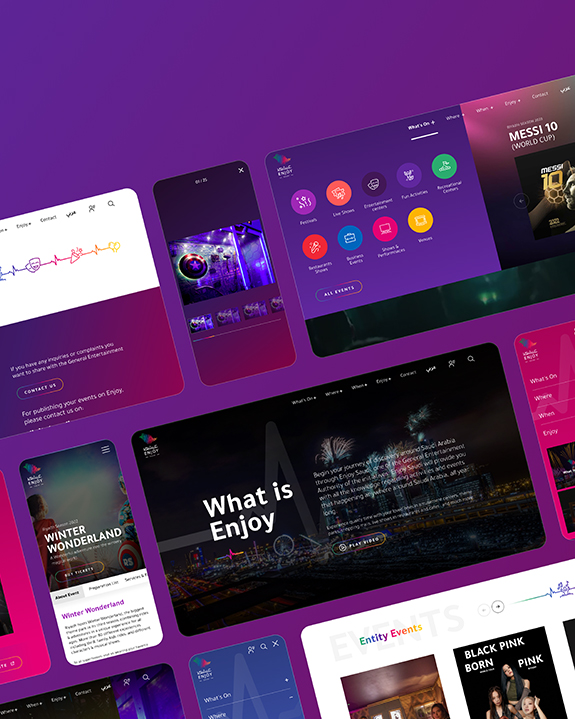

5) Design is editorial (for both languages)

Design isn’t decoration; it guides feeling and flow . Use “At a glance” spreads for strategy/performance/outlook. Write data captions that say what changed and why it matters. Pair typefaces and components so both languages hold hierarchy and rhythm; design right-to-left and left-to-right components together to prevent reflow or truncation.

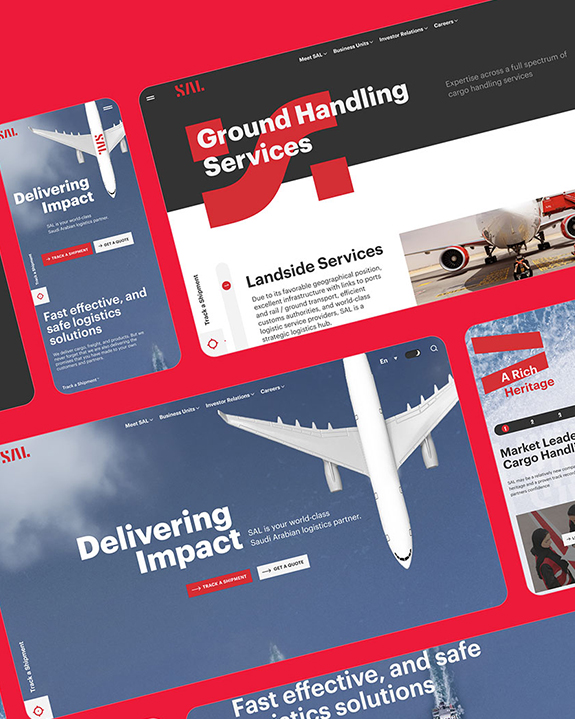

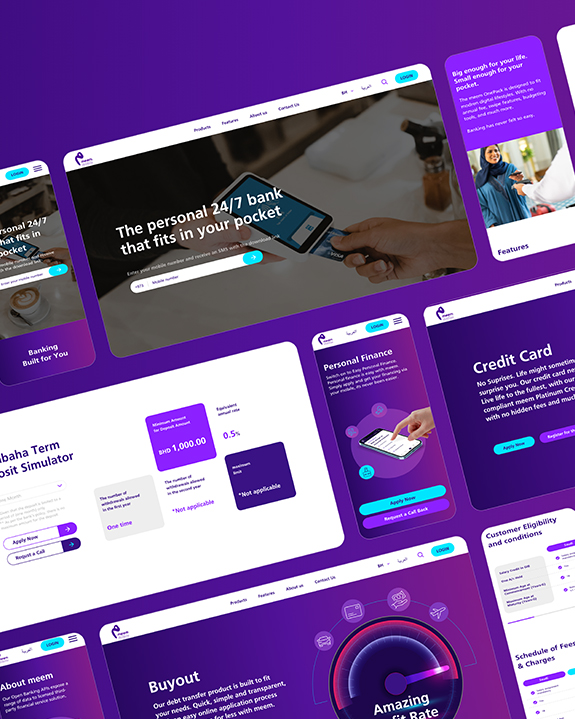

6) Go digital, and think like an editor and an assurer

Ship a microsite or interactive PDF with sticky nav, search, jump links, and an accessibility pass. Add a standards index that jumps to each disclosure, and keep a simple review matrix with version control. Wire analytics (chapter views, language split, scroll depth, exits) so next year starts smarter.