How to Build a Standalone

ESG Report Investors Trust

Standards, delivery model, and rules that hold up in assurance

Previously, ESG were limited to sections within an annual report. Today, they became investor documents with their own standards, controls, and audience expectations. You could list initiatives and call it a day, but capital providers won’t. They’re scanning for targets, pathways, controls, and comparability. This playbook shows you how to build an assurance-ready ESG report that reads clearly, maps cleanly, and stands up to review.

What you need to know (before you start)

Scope first

Be explicit about entities, geographies, and operations in scope.

One library, many frameworks

Build a single metric library and cross-map it to IFRS S1/S2, GRI, and the GHG Protocol.

Assurance is a design input

Every metric needs a method, boundary, owner, controls, and evidence.

Bilingual parity is designed in

Plan both languages from day one; never translate at the end.

Digital wins

Searchable, accessible, measured.

Who reads your ESG report (and what they scan first)

Why this matters:When the audience changes, the entry points change. Lead with pathways and governance for investors; lead with value-chain detail for customers.

The ESG at a Glance

(E • S • G)

Environmental

Climate change mitigation & net-zero targets

Biodiversity and habitat protection

Social

Community engagement & alignment with national development goals

Employee wellbeing & talent development

Human rights & supply-chain responsibility

Governance

Ethical business practices & transparency

Risk management & compliance

Board independence & accountability

Rule of thumb: Every line above needs a metric, method, boundary, owner, and timeline.

From National Vision to Measurable ESG

Aligning with national goals, then proving it

Countries publish long-term national visions (economic diversification, sustainability, innovation). Example: Saudi Vision 2030. Your ESG report should connect company outcomes to national priorities with specifics, then show how those priorities map to the UN Sustainable Development Goals (SDGs).

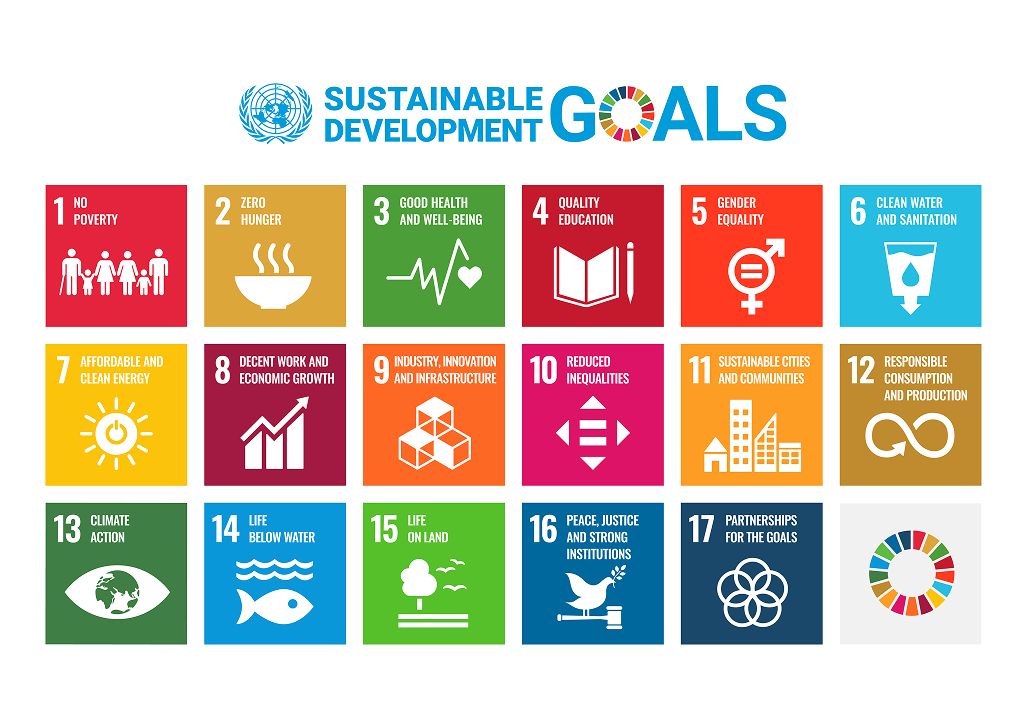

What the SDGs are and why they’re used

The UN Sustainable Development Goals (SDGs) are a set of 17 global goals adopted by all UN member states in 2015. They offer a shared language for environmental, social, and governance outcomes, so organizations can communicate impact in a way that’s comparable across markets and years.

The Sustainable Development Goals

A simple integration map (adaptable to any country vision)

Why this matters: Investors reward specific alignment rather than slogans. Name the pillar, show the program, publish the KPI.

A Delivery Model that Works (3 Phases, Two Gates)

This replaces generic “steps.” It’s the cadence that keeps ESG projects moving.

Phase 1: Define & Align

Vision & strategy alignment

(map to national goals and SDGs)

Materiality assessment

(stakeholders engaged; priorities defined)

Framework mapping

(IFRS S1/S2 + GRI + GHG Protocol)

Output: Scope statement, material topics, standards crosswalk v1, disclosure list.

Phase 2: Build & Validate

Data collection & validation

(methods, boundaries, sources, controls)

Metric library

(definition, unit, method, boundary, source, frequency, owner, controls)

Narrative development

(clear ESG story linked to performance)

Output: Operator-grade library + evidence folder + change log; draft narrative.

Phase 3: Deliver & Evolve

Design & communication

(bilingual, accessible, interactive PDF or microsite with search/jump links)

Assurance & release

(limited/reasonable; reviewer matrix; legal sign-off; analytics wiring)

Output: Scope statement, material topics, standards crosswalk v1, disclosure list.

Gate it: Scope Gate after Phase 1. Sign-off Gate after Phase 2 drafts & design. Two gates beat twenty “minor” reviews.

Standards You’ll Be Measured Against

Do this: publish a standards crosswalk, maintain one metric library mapped across frameworks, and document year-on-year method changes.

When to Publish a Standalone ESG Report (and when an ESG section is enough)

Choose a standalone ESG report if:

Capital providers, ratings, or regulators rely on your ESG metrics

Your operations have material E or S impacts (energy-intensive, large workforce, regulated sectors)

You need assurance on non-financial metrics (ISAE 3000)

You sell into markets requiring supply-chain transparency

You operate across multiple countries/languages and need deeper bilingual detail

You want hard alignment with national goals and the SDGs with measurable proof

An ESG section inside the annual report may be enough when:

Impacts are limited and stable, and stakeholders don’t require standalone depth

You’re early in the journey and building your first metric library

Your market norm is integrated reporting without external assurance expectations

Decision rule: If stakeholders are asking for assurance, cross-framework mapping, Scope 3 detail, or a climate pathway, go standalone, and cross-link from the annual report.

Assurance-Ready by Design (the quick test)

Metric library

exists and includes method, boundary, source, owner, controls

Evidence locker

(working files, approvals, source data) is organized and complete

Two touchpoints planned:

mid-process controls review; end-process evidence review

Version control

in place with a single decision log

Truth line: A number without a method is a claim. A method without an owner is a risk.

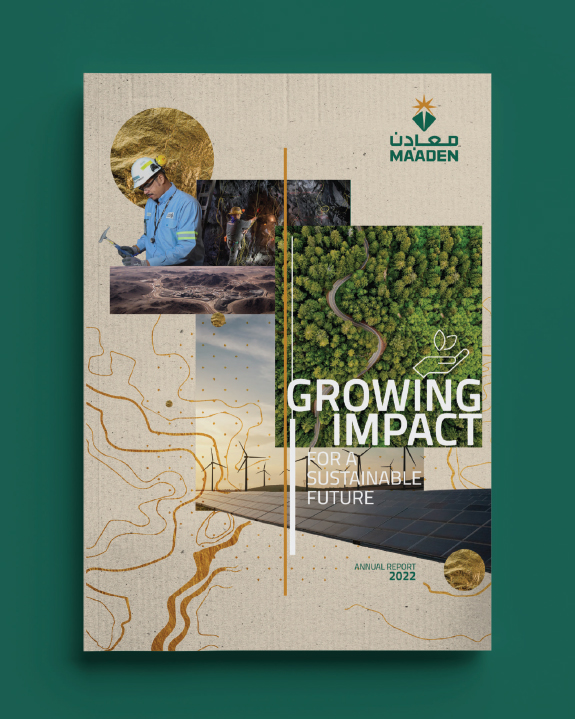

Design & Language that Build Belief

Bilingual parity

planned from day one (no last-minute mirroring)

At-a-glance spreads

(strategy, performance, outlook)

Chart captions

that state what changed and why it matters

Accessible digital

(search, jump links, contrast, alt text)

Photography with context;

pull-outs for milestones, risk notes, definitions

Do / Don’t for ESG Reporting

| Do’s |

Don’t |

| State boundaries and material topics up front |

Let scope drift across chapters |

| Map once; reference everywhere via a crosswalk |

Scatter acronyms through prose |

| Tie targets to capital and risk |

Announce goals with no funding or owner |

| Show Scope 1/2/3 with methods and data-quality notes |

Drop a number with no lineage |

| Design parity for both languages from the start |

Translate at the end and hope it fits |

| Ship a digital version with search and analytics |

Upload a flat PDF and call it done |

| Maintain a change log for methods |

“Fix” numbers late with no audit trail |

What “good” looks like (deliverables you keep)

ESG Strategy on a Page

(priorities, targets, owners, next steps)

Metric Library

+ evidence + change log

Standards Crosswalk

(IFRS S1/S2, GRI, GHG Protocol, local rules)

Bilingual Design System

(grids, charts, tables, components)

Digital Package

(interactive PDF or microsite with analytics)

Governance Pack

(review matrix, assurance plan, approvals)