Investor Confidence Isn’t Won in Boardrooms, It’s Built in Interfaces

In the Gulf, trust is shaped through experience , not declared in meetings.

The most powerful message investors receive? Is the one they don’t have to decode.

Investor confidence grows when the message feels intuitive, not encoded. Clear communication is non-negotiable in high-stakes environments. In the Gulf, where trust is earned through precision and presence, every interface must speak fluently to ambition, risk, and reward.

When the experience feels effortless, the message lands with conviction.

The Shift Investors Are Already Making

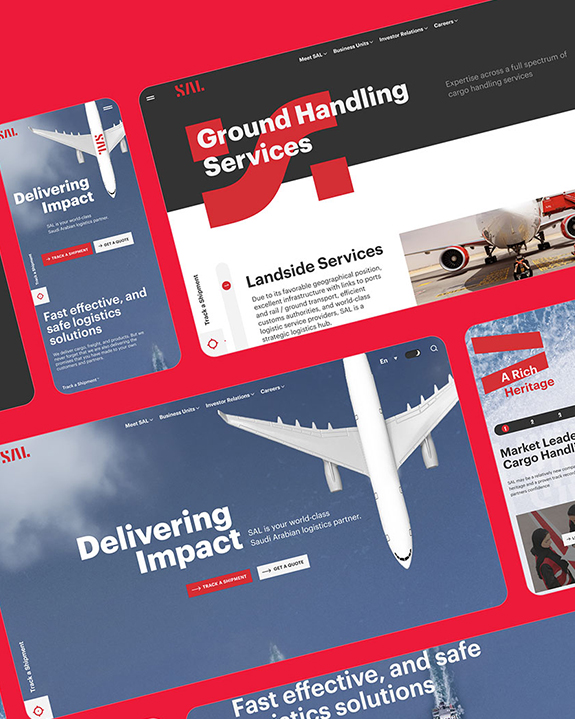

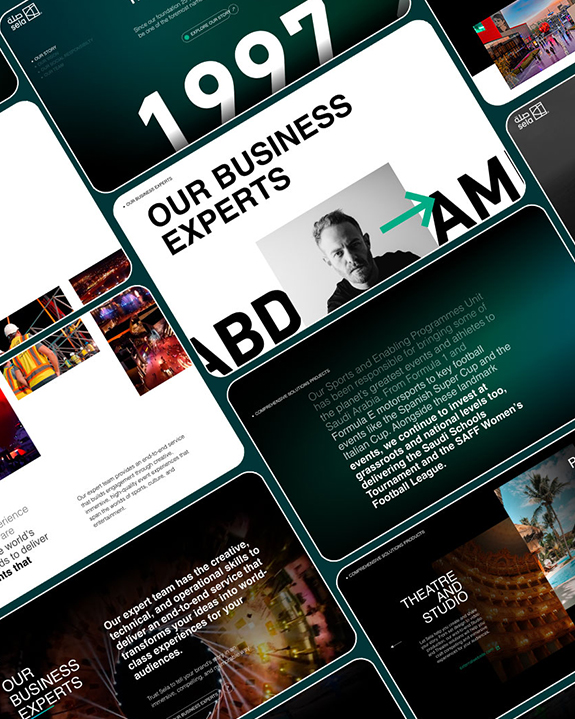

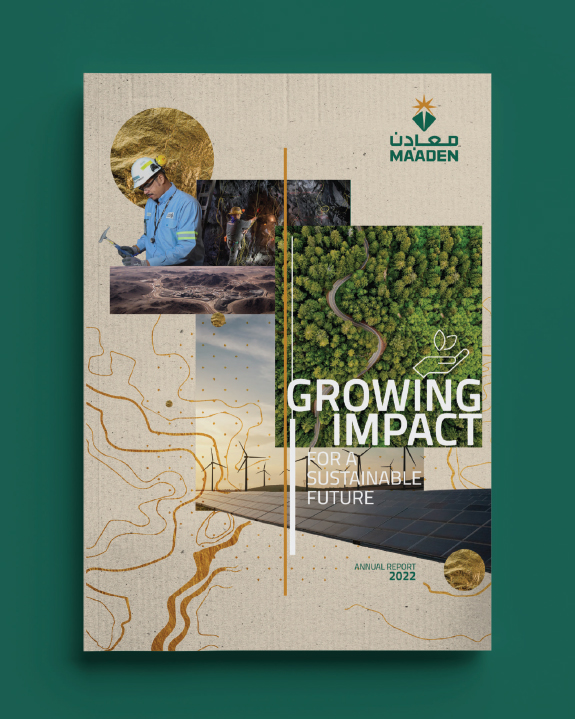

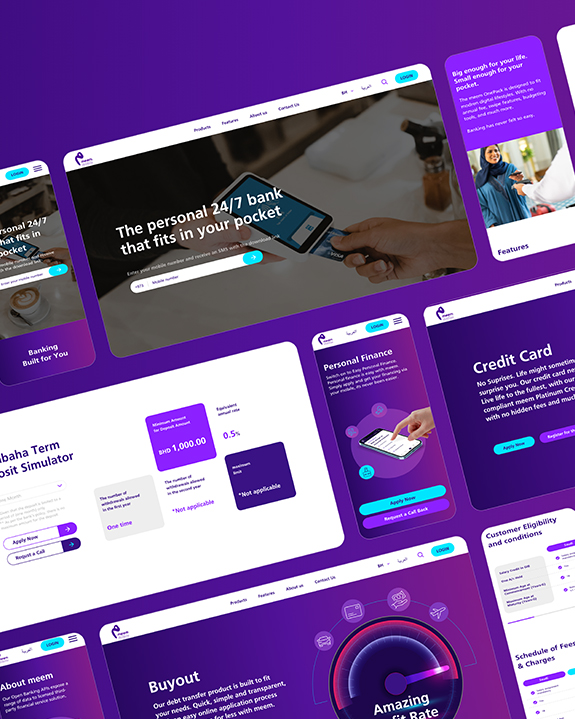

For decades, investor confidence was shaped in private, through pitch decks, polished presentations, and handshake diplomacy. Today, in the GCC’s fast-evolving enterprise landscape, confidence emerges through experience, built in the flow of an interface, the clarity of a caption, and the rhythm of a report.

What once relied on negotiation now depends on design.

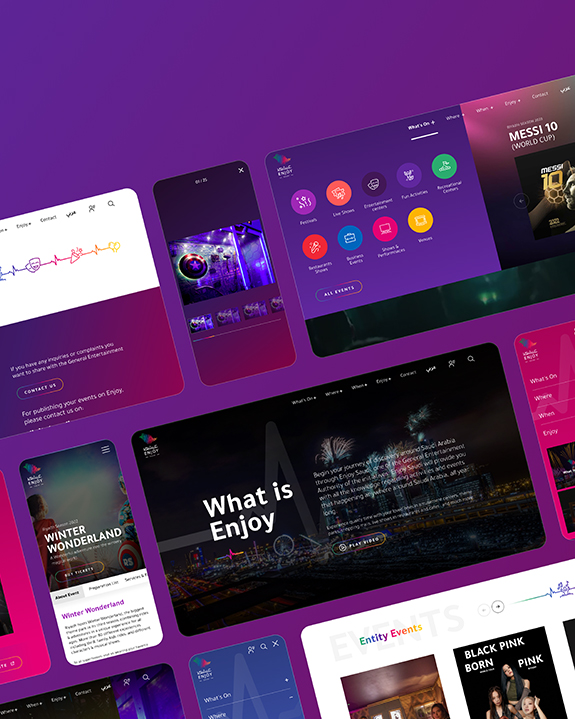

Investors no longer wait for quarterly reports to gauge performance. They explore platforms, test portals, and judge brands by the clarity of their digital experience.

In Saudi Arabia, Bahrain, and the UAE, where digital transformation is accelerating, interfaces have become the new due diligence.

What They’re Really Asking:

Does this brand deliver clarity or confusion?

Is the experience seamless or stitched together?

Can I trust this company to scale, adapt, and lead?

This shift goes beyond aesthetics or layout. In the Gulf, where trust shapes every transaction, the interface becomes a living expression of credibility . It’s where design meets intent, and where clarity signals confidence before a single word is read. Every detail, from tone, rhythm, and language, contributes to a larger truth: the experience speaks first.

Interfaces as Strategic Signals

An interface is a strategic signal. It tells investors how a company thinks, how it prioritizes, and how it treats its users.

| Interface Trait |

What It Signals to Investors |

| Clarity |

Strategic focus and operational discipline |

| Responsiveness |

Agility and user-centricity |

| Agility and user-centricity |

Strong governance and brand maturity |

| Emotional resonance |

Cultural intelligence and market relevance |

Across the GCC, where emotional depth and cultural alignment shape perception, a thoughtfully designed interface signals leadership before a word is spoken. Beyond aesthetics lies the real measure: brand integrity.

When the interface reflects the brand’s values, investors see coherence. When it doesn’t, they see risk.

Building Trust, One Interaction at a Time

Trust builds quietly, across micro-moments that feel seamless , not staged. Every click, scroll, and transition either reinforces or erodes confidence.

Consider this:

A frictionless onboarding flow signals operational excellence.

A clear, mobile-first dashboard reflects strategic foresight.

A well-paced content rhythm suggests editorial maturity.

These are trust-building mechanisms. And in the GCC, where enterprise decisions often involve sovereign funds, family offices, and long-term partnerships, trust is everything.

GCC Context: Why It Matters More Here

The Gulf’s economy runs on more than capital, it runs on relationships, reputation, and emotional credibility . Investors in the region are backing leadership, legacy, and long-term vision. That’s why every interface must feel intentional, respectful, and regionally attuned.

What resonates in the GCC:

Simple, direct Arabic copy, not stiff or overly formal

Visual rhythm that reflects clarity and care

UX that respects time, hierarchy, and cultural nuance

Strategic transparency that doesn’t overwhelm

Interfaces that feel rushed, cluttered, or disconnected from regional realities quietly signal misalignment.

What GCC Investors Notice (Even If You Don’t)

| Subtle Detail |

Investor Interpretation |

| Untranslated Arabic toggle |

Lack of regional commitment |

| Inconsistent formatting Weak governance or oversight |

Weak governance or oversight |

| Generic CTAs |

Missed opportunity to inspire action |

| Slow load times |

Operational inefficiency or tech debt |

| Overuse of stock imagery |

Lack of brand originality or cultural fluency |

These details may seem minor, but in high-stakes investment decisions, they become decisive. Because in the GCC, perception is tightly linked to performance, and every detail matters.

It’s time to expand the conversation. Let’s move beyond UX, as IX is the new frontier, where operational excellence translates into digital trust.

IX means:

Anticipating questions before they’re asked

Making performance, purpose, and potential visible

Translating brand values into interface behaviors

When interfaces reflect clarity, care, and control, investors understand the brand, and believe in it. Belief is what drives capital, partnerships, and long-term growth.

How to Build Interfaces That Inspire Confidence

Here’s a strategic checklist for GCC enterprises ready to elevate their IX:

| IX Principle |

Implementation Tip |

| Clarity over cleverness |

Use plain language, especially in Arabic |

| Visual rhythm |

Break content into digestible, skimmable sections |

| Localized resonance |

Adapt tone, imagery, and flow for GCC audiences |

| Strategic transparency |

Make metrics, milestones, and impact visible |

| Emotional intelligence |

Design for trust, not just transactions |

| Governance signals |

Show consistency in formatting, tone, and hierarchy |

| Cultural fluency |

Avoid Western metaphors or idioms that don’t translate |

| Mobile-first logic |

Prioritize speed, clarity, and thumb-friendly design |

Best practices alone won’t move the needle. In the GCC, where digital transformation aligns with national ambition, every interface carries weight. It reflects intent, signals leadership, and shapes how trust is built, click by click, scroll by scroll.

What to Avoid , Especially in Investor-Facing Interfaces

Avoid these common pitfalls that quietly erode investor trust:

Formulaic phrasing

Feels generic and lacks strategic depth

Overuse of jargon

Alienates non-technical stakeholders and clouds clarity

Signals lack of cultural fluency and regional commitment

Inconsistent tone or formatting

Breaks editorial rhythm and undermines brand maturity

Empty metrics or vague claims

Erodes credibility and leaves investors guessing

Over-designed visuals

Distracts from strategic messaging and slows comprehension

Neglecting accessibility

Suggests short-term thinking and weak governance

Every interface is a reflection of leadership. Sloppy execution doesn’t just hurt UX, it damages investor perception. And in the GCC, where reputational capital is often more valuable than financial capital, perception is everything.

The Future of Investor Confidence Is Interface-Led

In a region defined by transformation, the most trusted brands won’t just speak well in boardrooms, they’ll show up brilliantly in every interface.

Investor confidence is a product. And in the GCC, where trust is earned through clarity, care, and cultural intelligence, the interface is the new boardroom.

Where Trust Begins

Investors engage with more than numbers, they respond to the experience. Clarity now is the currency of confidence. Every layout, caption, and translation contributes to a larger truth: trust is built in the way the story is told.

If your platform doesn’t inspire confidence, your pitch won’t either. Build trust where it matters most, in the experience itself.

Because in the Gulf, where every click is a conversation and every scroll is a signal, the brands that lead will be the ones that design for belief, not just usability.