Turn your brand

into a clear signal of

execution, trust, and scale

Investors do not fund logos or landing pages. They fund clarity, control, and momentum. Your brand is the public proof of those three things. It tells a simple story: what you are building, why it wins, who is running it, and how fast it can grow in Saudi and beyond.

This guide gives you the playbook to make your brand investor ready without fluff.

What you will get

What Saudi and regional investors look for first

Messaging and proof grids that make due diligence faster

Bilingual and GCC realities to design in from day one

A 30, 60, 90 day plan to move the needle before your next meeting

The investor lens: who is reading you and why

| Investor type |

What they scan first |

Proof they expec |

| Angel and early seed |

Team, market insight, first signals of PMF |

Working demo, early revenue or waitlist quality, design that reduces friction |

| Seed funds and CVCs |

Go to market logic, unit economics, pipeline |

CAC, payback, churn or retention, referenceable customers |

| Series A VCs |

Repeatability, funnel math, hiring plan |

Cohort charts, sales cycle length, sales productivity, design system that scales |

| Family offices and SWFs |

Governance, risk, national alignment |

Clean cap table, board or advisors, alignment with Vision 2030 style goals, compliance confidence |

Investors reward clarity, control, and momentum. Your brand must show all three on page one.

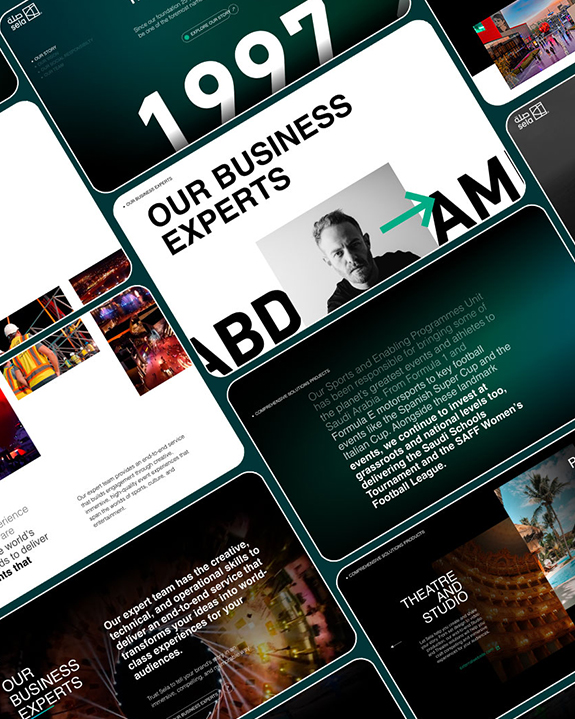

Brand as a system you can run

A story changes with context. A system keeps you consistent. Build these six layers and your story will stand up in every meeting.

the category you play in and the unfair advantage you are building

Proof pillars

3 to 5 claims you can defend today

Evidence

metrics, case studies, references, and demonstrations

how you speak in English and Arabic, especially when explaining, apologizing, or asking

product flows that match the promise, speed and accessibility included

Governance

ownership, policies, and controls that reduce risk

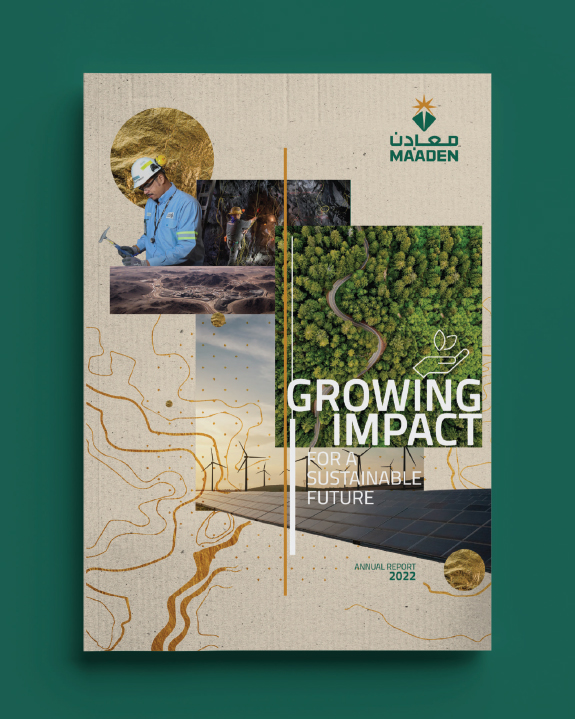

Positioning that belongs in Saudi now

Name the national priority that fits. Example: diversification, local content, productivity, sustainability.

Show the segment you start with and the adjacent segments you can credibly expand into.

State the moat you are building. Data, partnerships, distribution, network, or IP.

Messaging that investors can underwrite

Build a one page grid and use it everywhere

| Pillar |

Key message |

Evidence you show |

Metric to publish |

| Market |

The problem is large and present in KSA |

TAM with real sources, policy tailwinds |

Pipeline growth, conversion by segment |

| Product |

Users finish the job faster and safer |

Video demo, time to value reduction |

Completion rate, NPS on key flow |

| Traction |

People pay and return |

Cohorts, case studies with quotes |

MRR growth, retention, ACV |

| Economics |

You can scale without burning value |

CAC by channel, payback months |

Gross margin, sales cycle length |

| Team |

You can execute the plan |

Founders, key hires, advisors |

Hiring velocity, cycles shipped |

Use the same grid in the deck, the site, the data room, and the press kit.

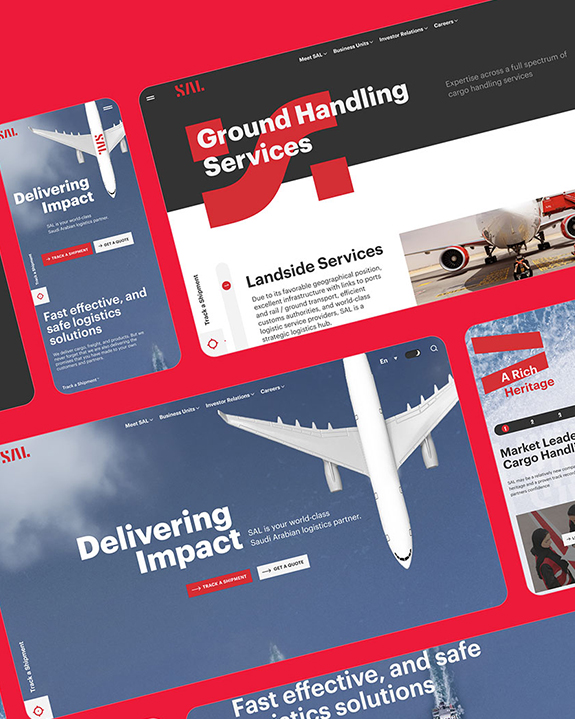

The pitch asset stack you need now

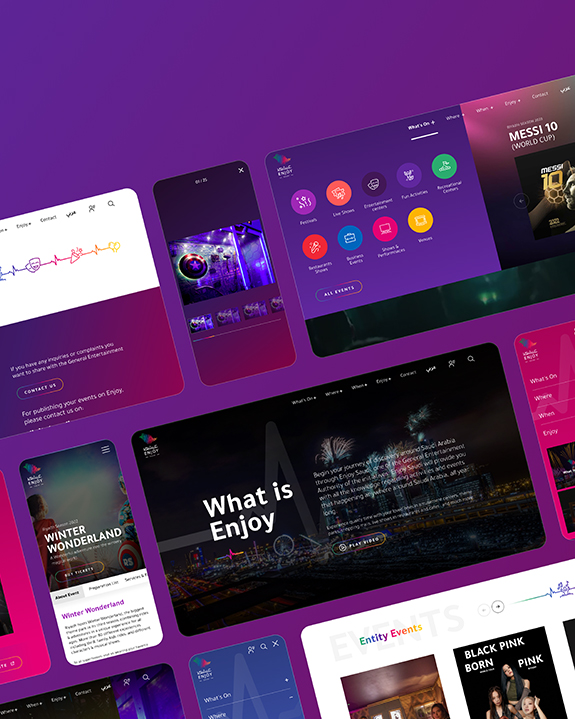

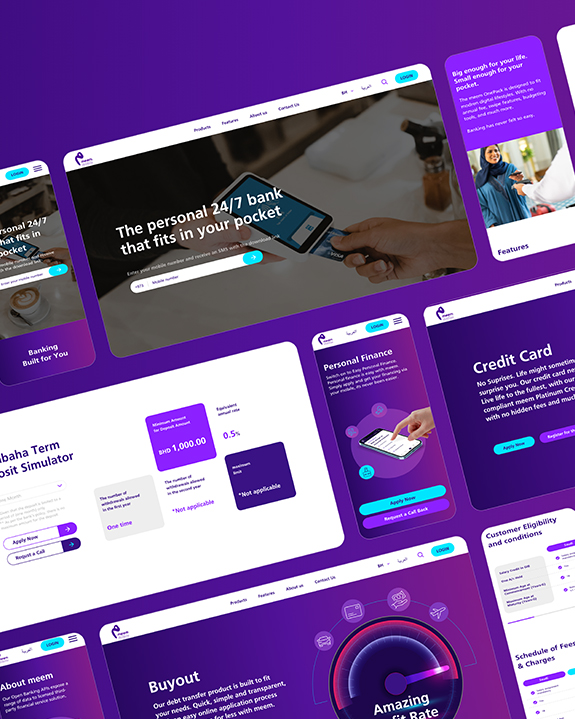

Homepage that answers four questions in 10 seconds

what you solve, for whom, why you win, what to do next

Product demo video

90 seconds, mobile first, captions in both languages

One pager PDF

positioning, proof pillars, three metrics, logos or names of referenceable customers where allowed

Founder LinkedIn profiles

clean story, shipped work, clear role split

Press kit

logo files, founder bios, product shots, 3 to 5 approved quotes

Case study template

challenge, approach, results, next phase, contact

Make due diligence faster with a clean data room

Folder structure

Company: cap table, articles, key contracts, trademarks, domains

Market: research, regulatory notes, partnership letters

Product: roadmap, design system, security overview, uptime history

Commercial: pricing logic, pipeline by segment, win and loss notes

Financial: P&L, cohorts, CAC and payback, forecasts with assumptions

People: org chart, top 10 roles to hire, ESOP policy

Legal and compliance: licenses, privacy policy, data handling

Rule:

one owner per folder. One source of truth per metric.

Build Arabic and English together. Plan line lengths, choose font pairs, set a style guide for formality and dates.

Mirror logic, not just words. RTL flows must read naturally, including forms and validation states.

Align examples and visuals to Saudi context. Payments, addresses, work week, holidays.

Decisions and dashboards should use both units where relevant. SAR and USD, Gregorian and Hijri dates if needed.

Publish a glossary for product and finance terms in both languages.

Product experience as the strongest branding signal

Investors open your product, not only your deck. Fix three flows first.

Onboarding

first success in two minutes on mobile, autofill smart defaults, progress shown

Core job

the one task you promise on the homepage, use the shortest path possible

Recovery

clear errors, safe undo, human route for help, resolution times visible

Add a performance budget. Speed is a feature. Accessibility is non negotiable.

Proof that moves a room

Before and after micro-demos

Show a 30 second clip of the old way versus your way

Put the clock on screen, speak in plain language, include Arabic captions

Customer quotes with numbers

“We cut setup time from 30 minutes to 6 minutes” head of operations, sector, region

Pair each quote with the exact metric and timeframe

One slide that shows chaos turning into a reusable system

List the tokens, components, and patterns your team now ships with

Metrics that matter by stage

| Stage |

Health metrics |

Investor grade targets to track |

| Pre seed |

Activation, time to first value, waitlist conversion |

60 percent activation for target segment, first paid pilot with signed letter |

| Seed |

MRR growth, retention, unit economics |

10 to 15 percent monthly growth, payback under 12 months, churn under 3 percent monthly in target use case |

| Series A |

Sales productivity, cohort expansion, gross margin |

Quota attainment for 70 percent of reps, 20 to 30 percent expansion on healthy cohorts, margin trending up |

Always publish definitions. A number without a method is a claim.

Governance signals that lower risk

Clean cap table and signed IP assignment

Two named advisors with sector relevance and time commitment

Clear information security policies and incident playbook

Board cadence and a short operating cadence inside the company

30, 60, 90 day plan to upgrade your brand before fundraising

Day 1 to 30: clarity and parity

Write the positioning and proof grid

Build the glossary and tone guide for English and Arabic

Record the demo and fix the homepage copy

Ship one strong case study

Day 31 to 60: product and data

Set the performance budget and fix the three core flows

Instrument analytics that map to your funnel

Clean the data room and assign owners

Day 61 to 90: distribution and references

Publish two founder essays or interviews that demonstrate insight

Run five reference calls and collect permissioned quotes

Train the team on the design system and messaging

Do and Don’t

| Do |

Do not |

| Tie your pitch to national priorities with evidence |

Name drop Vision 2030 with no measurable link |

| Put your best proof on page one |

Hide traction on slide 17 |

| Build Arabic and English together |

Translate at the end and hope it fits |

| Publish definitions next to metrics |

Mix booking, MRR, and revenue without context |

| Show the product finishing the job |

Lead with a montage that says nothing |

| Keep one story across deck, site, and data room |

Tell a different story in each channel |

Ready to turn your brand into a funding signal

If you want a team to tighten positioning, build bilingual assets, fix the three core flows, and package proof for due diligence, Spark can help . Your brand can earn belief before the first meeting ends.

Frequently Asked Questions

Do we need a full rebrand before fundraising?

No. You need a clear system and clean assets that prove execution. If your current design is readable and consistent, upgrade flows and messaging first.

How much should we localize for investors outside KSA?

Keep the Saudi proof, then add a short section on portability. Show what transfers and what must be rebuilt. Investors respect clarity on both.

What if we have little revenue yet?

Show velocity. Pipeline quality, activation rates, conversion improvements, time to value, and design debt converted into a working system.

Explain the job your model does, the data you use, the risks you avoid, and the part the human owns. Then show the outcome on a real task.